Cigarette tax seems still to be rising, albeit at a slower rate in United States, while, taxes on E-cigarette are still rare in USA. Due to more pressures on reducing adolescent uses, more legislators are considering to apply E-cigarette taxes. In this post we will focus on the impacts between E-cigarette tax and Cigarette tax.

Situation

“More legislators are considering to apply E-cigarette taxes in more regions in USA due to the reason of increasing “epidemic” of adolescent use.”

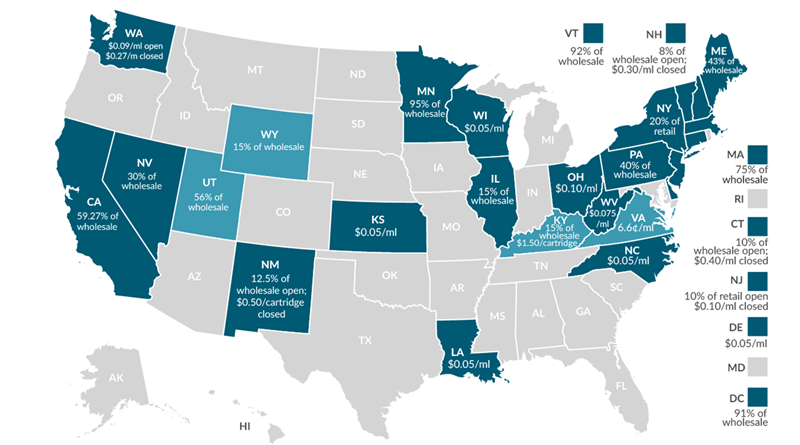

Back to 2019, only 9 states and the District of Columbia had vapor product tax. Comparing to Averagely $1.006 federal tax on each pack of Tobacco products in early of 2019. The selling price of Electronic cigarette seems to be more affordable to smokers. Thus more smokers attempted to use e-cigarette products as a substitute goods. In order to reduce this problem more legislators are considering to apply tax on E-cigarette.

Problem

“that higher traditional cigarette tax rates reduces adult traditional cigarette use, conversely higher e-cigarette tax rates increases traditional cigarette use and reduce e-cigarette use.”

As we all know, the goal of cigarette tax is to reduce tobacco use. So does E-cigarette tax. On 1st Aug 2020, 25 states will have a vaping tax—as well as D.C., Puerto Rico, two Alaskan boroughs, counties in Illinois and Maryland, and the city of Chicago. Based on a study, the authors show that increasing taxes on vaping products results in a corresponding and predictable increase in cigarette use. Likewise, increasing the cigarette tax boosts adoption of vaping products. Unlike previous studies, the authors don’t simply measure sales increases in one or both categories, but actual use of the products (McDonald, 2020).

Solution

Substantially differential taxes for favoring vaping products is the best goal to stabilise those problems.

It could be explained that cigarettes and vapor products seem to be economic substitutes. That means a price increase in one product will cause sales growth in the other (an effect called cross-price elasticity). As for new and uncommitted vapers, they are highly sensitive to price fluctuations in vapes and cigarettes.

Evaluation

Taxes on E-cigarette has been a tendency in legislators’ consideration. More policies (eg. PMTA from FDA) will be enacted in order for a more normative market. For vapors, considering to purchase more quality and valuable products would maximum their value on every buck they spend.

If you are confused to go, Healthcabin would be one of your trustworthy suppliers for all your needs of vaping devices at best price in the market. The FDA PMTA is going to be enforced on 10th Sept 2020, you may not find your favorite vape devices in vape stores after that time, so shop vape devices online will be your best choice.